GOVERNMENT INTERVENTION, ANYONE?

GOVERNMENT INTERVENTION, ANYONE?

As the negative fallout deepens from the government roof batts and solar panels stimulus saga, the question becomes whether Peter Garrett will survive as Minister for the Environment, Heritage and the Arts. It seems to confirm that governments are pretty useless in areas other than defence, law and order and public infrastructure.

What about education, health and social welfare, do I hear you ask? I’d suggest that governments have been drawn into these areas simply as a safety net from the pathologies that will always flow from aberrant taxation. Think about it. May not the fact that government has been drawn into the business of education, health and social welfare signify that too many people have paid too many taxes over three levels of government for too long in Australia, and that this acts to destroy many other possibilities and opportunities?

Maybe we should more rightly conclude that ‘taxation and bloated governments destroy’? In my opinion, this is a much more productive way in which to consider the world’s failing economies. ‘The only certainty in life is death and taxes’ could be re-written ‘the only certainty in life is death and land rent’ because, whereas taxes can be abolished, land rent cannot. It is either collected privately, publicly, or both.

John McRobert has made a great contribution in educating Australians to the devastation taxes wreak upon the Australian economy. While his suggestion of a 2% tax on spending in Online Opinion yesterday would be a vast improvement on what we have today, I was inclined to respond:

“John McRobert has long displayed an excellent understanding of the vast damage wrought upon the Australian economy by an incredibly perverse taxation ‘system’. The role of taxation on industry and thrift in delivering the world into the GFC is undoubted.

However, I am less seized by his spending tax to replace the multitude of taxes with which we’ve been shackled. How would this deal with the undergound cash economy – or with barter? Also, although John’s proposal is infinitely superior to what we have now, a tax on spending will still tend to inhibit spending to some small extent.

Nor is his spending tax likely to curb property bubbles which is clearly the other half of the reason we’re having this GFC. A tax on land values would do all John McRobert is seeking and then some. It also addresses housing unaffordabilty for this and future generations of Australians by putting paid to the property speculation industry.”

DECLINING REAL WAGES AND RISING LAND PRICES ARE THE EFFECTS OF TAXATION

I’ve showed here and here that real wages increases actually topped out at the outset of the 1970s, at the peak of the Kondratieff Wave, and have consequently headed downward into the current depressionary K-wave trough.

Had we drawn more revenues from land immediately post WWII, and less from production and industry, the real wage increases and prosperity up to 1972 would have been even greater. And had we captured only half our land rent since 1972, my report “Unlocking the Riches of Oz” demonstrates that Australia’s GDP would now be more than $2 trillion per annum (double what it is today).

If we took the more natural approach to revenue raising, we’d be able fend for ourselves much better without government intervention. But now, like the FIRE sector, government has come to believe that the world revolves around it when, as with the FIRE sector, government has grown to pathological proportion at the expense of real wealth creation, whether it be of a Liberal (conservative) or Labor (liberal) stripe.

When we come to see political parties, government and the FIRE sector for what they are, the primary ingredients of the GFC, then we might be able to remedy it; but not before.

In the meantime, governments of all persuasions will continue ‘stimulating’ economies, bailing out banks and real estate markets while, as it’s being done in the eye, an ill-informed public clings in misguided hope to one or other of the impotent political parties for a salvation that aint going to come.

The best stimulus any government can apply right now is to abolish taxes and capture its land rent. It’s revolutionary, but it works. Unfortunately, neither the Right nor the Left accept this solution, because it’s only the Georgist school of economics that advocates it. Interesting that it was predominantly Georgist economists who called the GFC. Maybe they’ve studied and learnt the lessons of history better?

THREE STORIES

THREE STORIES [Once upon a time …]

[Once upon a time …]

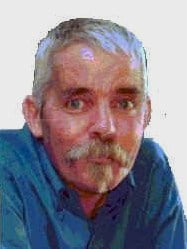

Tony O’Brien was born in Sydney, grew up in Melbourne and was drafted into the army, serving in the infantry in Vietnam for a year in 1966-7. He met and married Dinah in London where he worked as a landscape gardener before settling back in Adelaide with their three children.

Tony O’Brien was born in Sydney, grew up in Melbourne and was drafted into the army, serving in the infantry in Vietnam for a year in 1966-7. He met and married Dinah in London where he worked as a landscape gardener before settling back in Adelaide with their three children.

GOVERNMENT INTERVENTION, ANYONE?

GOVERNMENT INTERVENTION, ANYONE? IT GETS WORSE …

IT GETS WORSE …