IT WAS LOCAL BEFORE IT WENT GLOBAL – AND WHERE WERE THE RISK MANAGERS AND ANALYSTS?

It’s an understatement to say that the US rating agencies’ sins of omission proved to be costly. They’d been given respect they didn’t deserve, so economists and policy makers were blindsided to the financial collapse that has settled across America.

The agencies failed to get their heads around the central fact that so obviously mocks them now; that the real estate bubble on which much US debt was leveraged didn’t represent real wealth at all. It was a chimera. That treasuries and central banks also missed the point clearly indicts the study of economics. Something is horribly amiss!

The same mindset that levied counterproductive taxes on industry yet gave benefits to negatively geared properties, in addition to depreciation allowances, also tended to hide the reality of the real estate bubble.

We’ve designed tax systems to mollify incredibly selfish landed interests, but it’s only at the bursting of real estate bubbles that the complicity of revenue regimes becomes exposed. Incredibly, even at these times most analysis becomes diverted from recognising that pathological tax regimes are directly responsible for the creation of recession and depression: and so we repeat them, again and again.

Given that the economy leverages off and is directed by real estate, there’s also a stunning absence of analysis of the Australian real estate market by federal government authorities. Privately-held real estate sales data is purposefully misinterpreted by the real estate industry to spread self-serving disinformation. Christopher Joye of RP Data-Rismark goes so far as to say that Australia has experienced no real estate bubble at all. The RP Data-Rismark National Dwelling Value Index which rose by 1.6% in the first quarter of 2009 is used to validate the point.

Haven’t other economic experts reassured us also that Australian banks have been more circumspect in their lending practises than the US, anyway, so any recession we have can’t be as bad? They certainly have, but these are the same people who failed to see the recession coming, and they continue to accept, even disseminate, false information about the extent of our real estate bubble.

THE MISSING DETAILS

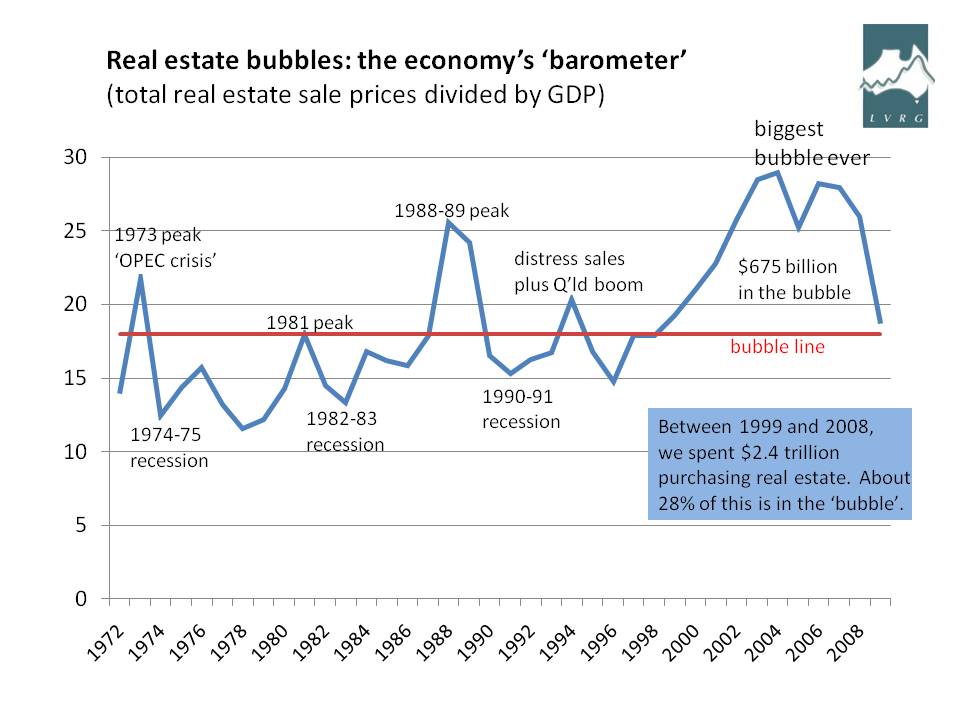

The chart displays the overpowering size of Australia’s recent real estate bubble against GDP. During the period of the bubble, from 1999 and 2008, we spent $2.4 trillion in real estate transactions. Of that amount the $675 billion above the ‘bubble line’, will need to be liquidated. In terms of a $1.1 trillion dollar economy, it may be seen that a write-down of $675 billion portends an enormous meltdown of the Australian financial system; one to which our big four banks are exposed in extremis.

The University of Western Sydney’s dogged and brilliant associate professor Steve Keen has replicated a ‘Long Term Real House Price Index’ for Australia similar to the US Case-Shiller Index, linking house prices to consumer prices from the late 19th century. It suggests the Australian index has actually peaked at some 1.7 times the US index!

This acts to highlight the extraordinary disinformation spread about by real estate industry bubble-deniers. We’re not simply experiencing collateral damage from the bursting of the US residential property bubble, as claimed by federal politicians and exoneration-seeking economists within the RBA and Treasury, but have inflated our very own real-estate bubble that dwarfs that of the US in relative terms.

It is becoming clearer by the day that the only other difference between the US and Australian bubbles is the timing of their bursting. That the relatively larger Australian bubble extended as long as it did in comparison with the US and UK was mainly because of Queensland and Western Australia’s booming mineral sales; but that has slowed for now.

The latest RP Data-Rismark real estate commentary is mysteriously silent about Australian real estate sales turnover falling 30% over the second half of calendar year 2008. This bursting of the Australian bubble was reported in April on “Crikey” and the ABC’s “Lateline Business” by Gavin Putland, director of the Land Values Research Group. The First Home Owners’ Boost, the Australian government’s very own version of US subprime loans, has inflated the lower end of the residential property market and helps explain the 1.6% uptick in prices so far this year.

But as the economic downturn deepens, people will have to say goodbye to forlorn hopes of obtaining a better price for the properties they need to sell in a stronger ‘late-2009 recovery’. So, just as happened in the US, the superheated Australian real estate market will become glutted with unsold properties.

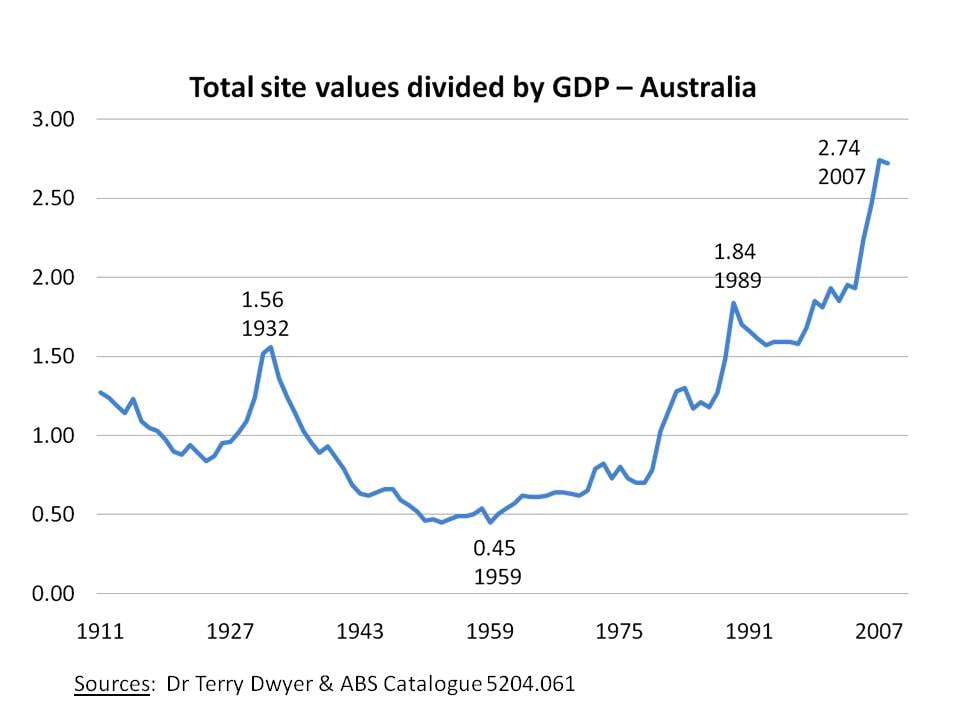

We’re at the turning point of the nefarious boom-bust cycle. The chart below demonstrates that our land prices have a long way to drop before they approach their historical average relationship of 1.1 times GDP. If they don’t overshoot on the way down, this will represent an average decline of 60% in site values, or a drop of some 50% in improved real estate values.

THE FIVE STAGES OF GRIEF

Dealing emotionally with an economic depression may be likened to Elisabeth Kubler-Ross’ five stages through which grief-stricken people pass. We may expect to respectively experience:

- 1 Denial

- 2 Anger

- 3 Bargaining

- 4 Depression, and

- 5 Acceptance.

Due to the lack of official information in connection with real estate, many Australians remain in Stage 1: ‘Nothing has really happened here; some prices are going up; Australia is different.’

Policy makers are faced, however, with an increasing amount of evidence as to “where we’re at” as outcomes from Australia’s speculative real estate excesses are starting to loom large. So that our politicians may avoid the numerous stumbling blocks that are likely to be met at each stage of the process (this might include trying to bail out banks rather than insisting they quickly write down their mortgages to market reality), they need to acknowledge the inevitability of Stage 4, move quickly to ‘Stage 5’, then urgently address the necessary structural revenue reforms.

That our bubble didn’t burst until recently (in terms of turnover, if not price) could be used to our advantage if we want to avoid some of the financial and social distress that has struck the US and Europe. Should we fail to do this, we’ll mindlessly ape their mistakes.

GENUINE TAX REFORM

For Australians to ensure a quick-exit from the economic depression, the Rudd government could not have positioned Ken Henry’s “Australia’s Future Revenue System” (AFTS) more opportunely.

Unfortunately, however, the history of previously sorties into ‘tax reform’ demonstrates that the exercise inevitably degenerates into a simple switching of emphasis between income and sales taxes, hopelessly alternating on each occasion from one back to the other.

There is great risk that AFTS will fall into such sham ‘reform’ again, but, if the Henry inquiry is to encourage confidence and productivity, it is clear that the country desperately needs to slash taxes savagely in favour of greater land value capture – via municipal rates and reformed ‘all-in’, flat rate State land taxes.

“Unlocking the Riches of Oz”, my 2007 study of recurrent real estate bubbles promoted by an errant tax system, demonstrates that greater emphasis on land-based revenues could double Australia’s GDP in short order. The measure also has positive implications for decentralisation, the rejuvenation of our regional areas where land values are cheaper, and for creating a more sustainable economy.

It would be far easier on the national coffers, moreover, than putting future generations of Australians into hock through the sort of costly and questionable government interventions we’ve not only witnessed overseas but also increasingly at home. Freeing up labour and capital from taxation is a major initiative, but the writing on the wall suggests that it needs to be done urgently.