The only doubt that Australian real estate prices are in a bubble of gargantuan proportions resides in the minds of analysts such as former Treasury employees Paul Bloxham, Christopher Joye and their wishful adherents.

By publishing their highly contrived bubble denials, newspapers ingratiate themselves with their real estate advertisers and spruikers for the industry, thereby obscuring the overwhelming truth about the real estate bubble. It is relegated to the occasional article by Steve Keen, Gerard Minack, Gavin Putland or myself, or a rare IMF release.

The latter, though, are usually accompanied by a put-down from a disciple of the Bloxham-Joye school not noted for having found anything wrong with skyrocketing land prices other than an imaginary “shortage of supply”.

No guys: shortage of supply doesn’t cut it. Nor did it cut it in California. Er, how about an errant tax system that gives all the wrong signals ….?

It’s most heartening therefore to see the great number of thoughtful people not sold on the “all’s well” line the media has constructed for them now having their own say in Prosper Australia’s call for a residential buyers’ strike as taken up by the social reform group GetUp.

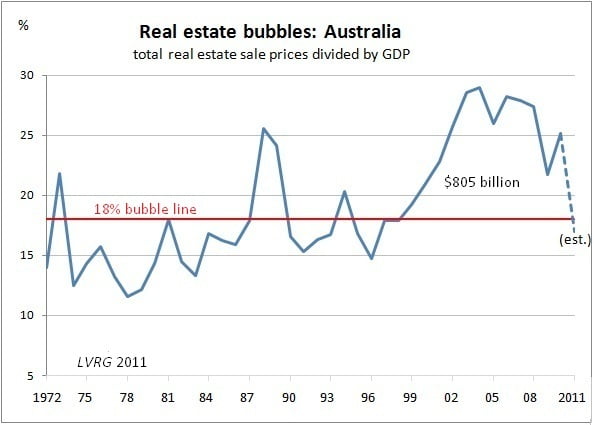

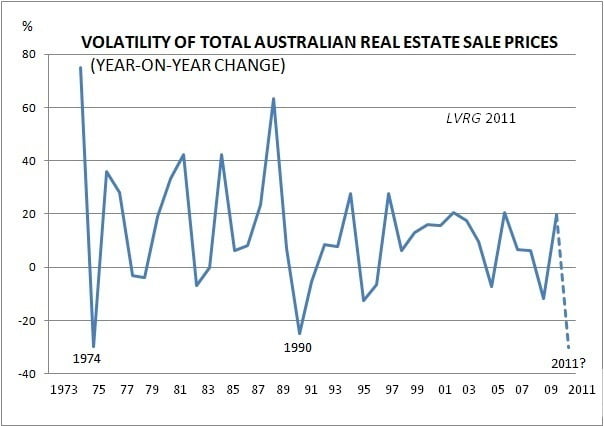

It might assist discussion for me to provide an interim update of the Kavanagh-Putland Index. This is in two parts, showing 1) total real estate sale prices for Australia divided by GDP, and 2) real estate volatility as a driver of the economy’s direction.

I should emphasise that the broken lines for the current year represent incomplete figures. Although they are extrapolations based upon 2011 real estate sales data from South Australian and Western Australian government departments, I consider figures to come from the other states and territories will eventually confirm these dotted lines.

NOTES:

(A) The 18 per cent bubble line is simply empirical. (With the exception of the last of the banks’ 1994 distressed sales sell-off in other states, and the contemporaneous boom in Queensland, any time the ratio has surpassed 18 per cent Australia has experienced a recession. The better guide, though, is the ‘volatility’ chart.)

(B) During the period of the current bubble, from 1999 until 2011, we’ve expended some $2.8 trillion on real estate, $805 billion of which appears to be within bubble territory.

(C) A significant economic recession has been indicated when aggregate sales prices decline by 20%.

One (weak) argument you hear from property bulls is that “we are not USA, Australia is different”

Well if you look into it we’re very similar…

USA – NINJA loans

AU – First home buyers grants

USA – subprime loans

AU – 90-100% of the value of the house loaned out. If that’s not subprime then I don’t know what is!!

There are soo many more similarities. Just look into it

12 months ago there was complete denial that real estate was in trouble, but now the realization is beginning to dawn on many that something terribly serious is about to occur in Australia. Australian housing is vastly, dramatically overpriced, by all reasonable measures. The recent analysis by The Economist is right on the money, and anyone will see from the excellent blogs on AustralianPropertyForum.com just how overvalued Australian housing really is:

http://australianpropertyforum.com/pages/blogs/

The bigger the boom, the bigger the bust, and the property boom that began in Australia in the nineties evolved into the greatest real estate bubble known to mankind. The bust that’s coming will be a doozy. As 2011 unfolds the spruikers will come to understand that real estate in Australia is dead for generations. During the next two years we can expect to see vacancy rates and inventory levels surge to unprecedented levels as house prices collapse by up to 40 or 50% in most parts of Australia. This might sound extreme, over the top. But how over the top were the 200% to 300% rises in house prices we saw over the past decades. A 50% fall is nothing in the scheme of things, it just brings prices back to a fair level. The bubble is dead. Long live the new new paradigm, where an average family can finally afford a decent home in Australia. It’s been a long time coming, but soon it will be time for the bears to party. Bring it on!

Maxxx Carnage!!

Bubblepedia

Hi Bryan, thanks for the update, RP Data’s Cameron Kusher recently stated that 2010 recorded the lowest number of national housing transactions since 1996. Would we be able to get an update on the 100-year chart of aggregate land to gdp value, that chart won’t be wasted, particularly while the topic is hot on getup, etc.

That’s a good question, David. We put the value of total property sales over GDP, that is, one national aggregate over another, on the assumption that a flattish (maybe gently rising) line would be OK, because it would denote real estate sales to be keeping pace with GDP growth.

Even a declining line might be healthier. It would suggest the productive side of the economy is outstripping real estate sales activity – surely a good thing?

When the ratio increases against GDP, that shows a property boom is afoot; real estate is doing better than the economy (GDP). But the boom then morphs into a more destructive bubble once the ratio of total real estate sales prices goes beyond the 18% to GDP line, i.e. negative economic implications will ensue once the line retreats below the line again.

The banks don’t understand this; they just keep on lending and their risk management fails.

The dotted line is our estimate that after a 12-year bubble, real estate sales are about to retreat below the 18% line (where they should be) once again, connoting the bursting of a bubble.

Watch this space ….!

Bryan, Excellent piece. Would you please explain why you take “the total real estate sale prices for Australia divided by GDP”