BUSINESS SPECTATOR

Chinese buyers don’t want your house, they want the land

Florence Chong

Forget about off-the-plan apartments. What cashed-up overseas Chinese buyers really want is a house in Australia, and more precisely, the land on which the house sits.

For the right house in the right suburb, they are outbidding Australian buyers by $100,000 to $200,000 – and sometimes more – to secure the property. They are importing inflation to their country of choice.

“Many people say, erroneously, that Chinese investors are only buying new-built – I can say categorically that that is not true,” says Andrew Taylor, co-founder of juwai.com, a property website visited by 1.5 million potential Chinese investors each month.

“To most Chinese buyers, re-sales (existing properties) are far more appealing,” says Taylor.

Taylor estimates that Chinese investors spent $5.3 billion buying Australian residential real estate in 2013 – but this is a mere drop compared to the estimated $38 billion to $50 billion they spent buying houses overseas last year.

“The bulk of our enquiries are for established homes, priced at $600,000 to $1.1 million in Australia – the sort of price range most Australians are also targeting.”

One buyer, who didn’t want to give his name, experienced the competition first-hand recently when he looked to buy a home in Epping, a Northern Sydney suburb.

“We saw this house on a Saturday afternoon and when we went to make an offer on the Monday morning, it was already sold – $200,000 more than the asking price ($1 million),” he says.

He subsequently found out that the young Chinese buyer intended to knock it down and spend another $500,000 building a new house on the site.

Veteran Sydney agent Barry Goldman says: “The majority of Chinese buyers prefer to purchase brand new property, or if not new, the property must be substantially renovated or knocked down and rebuilt.

“In Sydney’s leafy mid-north shore suburbs, it is not uncommon to see old houses knocked down and brand new double brick two-storey mansions in their place,” says Goldman, chief executive of Leda Real Estate.

Joseph Ngo, branch manager of LJ Hooker Glen Waverley agent in Melbourne, says it is not unusual for his agency to sell homes in sought-after Melbourne suburbs for $100,000-$200,000 above the expected sale price.

“I recently sold a home for $2.3 million – $500,000 over the asking price,” he says.

“They pay $1.2-$1.3 million for a house and think nothing of tearing it down. Then build a 60-square (557 square metres) mansion on the land. They are buying the land, not the house,” says Ngo.

John McGrath, chief executive of McGrath Estate Agents, says: “We have seen buyer inquiries from clients of Chinese origin (local and overseas) double in the last 12 months.”

Citing figures from the FIRB, McGrath said 9,768 approvals for residential real estate purchases or development were given to foreigners in the 2012 financial year – compared with 4,715 approvals in 2009-2010.

NSW experienced 45 per cent growth – the highest in the nation – in foreign investment in residential real estate.

In total, FIRB recorded residential sales of $4.2 billion to overseas Chinese buyers in the 2012 financial year – up 70 per cent on the $2.4 billion recorded in 2009-10.

Many of these buyers have friends or relatives in Australia to bid for them. Those without the local connections are still able to purchase – and there have been countless anecdotes of overseas Chinese buyers flying in to inspect and buy Australian properties they found on the internet.

According to the FIRB website, foreigners can buy established properties in Australia if they have valid visas – for example, work or student visas. The rationale is that they need somewhere to live, but must sell when the visa expires. While foreigners are otherwise technically not allowed to buy established homes, a Canberra government source said non-resident foreign persons can buy, but they need to apply for approval to buy established dwellings for redevelopment.

Juwai’s Taylor says China’s economic ascendancy has unleashed unprecedented purchasing power for its citizens, and is now washing up on the shores of Australia, the United States, Europe, South America, and Southeast Asia.

“The true power of the Chinese buyer is represented by more than 63 million people whose wealth and incomes provide them with the ability to purchase international property,” says Taylor, who points out that 90 million Chinese search for property online every month. More than 60 per cent pay in cash.

Globally, Taylor says Chinese purchases of residential properties totalled at least $38 billion and possibly as much as $50 billion last year.

And just as they are moving out of tier one cities in China, overseas Chinese investors are now moving out of capital cities, like London, to Manchester and Birmingham.

In Australia, Taylor says, the Chinese are also buying in tier two cities – Gold Coast, Perth and Adelaide. And surprisingly, juwai.com is getting enquiries for properties in Wagga Wagga, in the south west of NSW.

“We didn’t really understand why, until we found out that a Chinese company has made a big investment in Wagga.” (The state-owned Wuai Group has partnered with Sydney-based company ACA Capital Investment to build a $400m trade centre in Wagga.)

The mainland Chinese passion for real estate remained unfulfilled in their home market until about 15 years ago, when private ownership was first permitted, according to Taylor. “They are going through their first property cycle. Property is like gold to them.”

More from Florence Chong

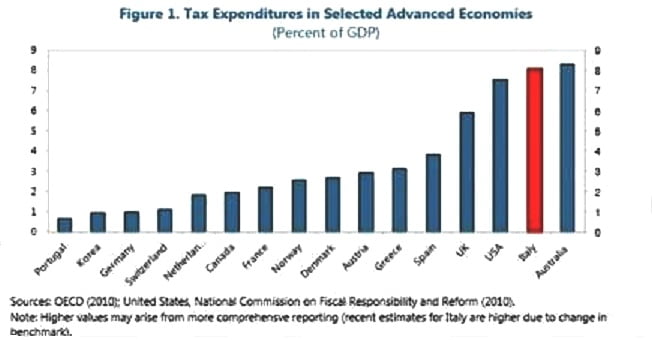

One way to come to the same conclusion concerning the need for revenues to come from an all-in, single-rate charge on land and natural resource values is to examine where all the tax concessions (read privileges) currently lie.

One way to come to the same conclusion concerning the need for revenues to come from an all-in, single-rate charge on land and natural resource values is to examine where all the tax concessions (read privileges) currently lie.