As suppression of warnings on the housing bubble by the media continues, many thanks are owed to Independent Australia:-

SUBMISSION TO ACOSS-ACCI TAX REFORM SUMMIT

CANBERRA, OCTOBER 1996

Philip D Day – 20 August 1996

Summary – this submission:

ADDRESSES the following deficiencies and incongruities which currently characterise public revenue raising in Australia:

• the inordinate dependence upon a revenue source which inherently penalises work, skill, enterprise, self-reliance and saving

• the manifestly unequal scope for tax minimisation (and avoidance)

• the increasing vulnerability of the revenue base to erosion by means beyond the control of national economies

• the ever-increasing complexity of tax legislation

• the exceedingly high compliance costs, particularly for small enterprises

• the disincentive impacts of payroll tax on employment and indirect taxes on business inputs

• the discriminatory impact of state land taxes

• the exacerbation of urban sprawl by local government rates based on improved capital values

• the failure to capture massive and inflationary windfall profits conferred on landowners and developers by public planning decisions

• the vulnerability of the environment to “development” motivated by the prospect of speculative land value profits

• the inadequacy of funds available to fairly compensate property owners disadvantaged by public planning decisions

• the inordinate diversion of national savings into speculative property investment

• the cumulative impact of unearned land value profits upon socio-economic inequality.

REVIEWS the rationale of public revenue raising, and highlights the contradictions evident in a society seeking solutions to structural unemployment and socio-economic inequality through ever-increasing encroachment upon the finite natural environment.

ARGUES that a gradual shift away from taxes on productive labour and capital towards charges upon the consumption of land and other finite natural resources (rather than upon the consumption of socially desirable goods and services) would mitigate the foregoing deficiencies and incongruities and establish Australian public revenue raising on an environrnentally responsible base that was demonstrably transparent, simple and cost-effective, equitable, efficient and incapable of avoidance.

SUBMISSION TO ACOSS-ACCI TAX REFORM SUMMIT

DEFICIENCIES AND INCONGRUITIES

•1. The deficiencies itemised hereunder relate to revenue raising measures administered variously by Australia’s federal, state and local governments. Responsibility for these measures has varied over time, as has their incidence relative to total public revenue.

(1) The bulk of Australian public revenue is derived from the taxation of personal and corporate income, literally by taxing hard work, skill, enterprise, inventive genius, self-reliance and saving – all things which, in any other context, society seeks to promote and reward. In the case of welfare recipients, self-reliance (and their honest compliance) is expressly discouraged by arbitrary limits upon the earning of income.

(2) Taxes based on the voluntary disclosure of the taxpayer’s income are subject to innocent error compounded inevitably by a tendency to understate income and overstate deductions. Honest people therefore pay more tax than the less honest (and pay more because of the less honest). Scope for tax minimisation available to the self- employed and those engaged in entrepreneurial activities is denied to PAYE wage and salary earners who contribute a major proportion of tax revenue; and a cash economy, largely immune from taxation, flourishes outside the tax system. Perceptions of the widespread scope for avoidance and evasion available to others and resentment of the resultant inequity operate as an ever-present inducement to cheat.

(3) The globalisation of finance, the immediacy of electronic movements of capital and the emergence of transnational regional economies, coupled with the scope for transfer pricing by vertically integrated transnational enterprises and increasing sophistication on the part of corporate lawyers and financiers, is increasingly eroding the conventional revenue sources available to nation states.

(4) Efforts to close loopholes and minimise avoidance and evasion, coupled with attempts to devise supplementary tax revenue devices, have resulted in extraordinarily complex tax legislation administered by a very substantial bureaucracy. The principal statutory source of public revenue, the present Commonwealth Income Tax Assessment Act, ran to 126 pages when it was first introduced in 1936. It has had to be amended every year since and, together with its associated legislation relating to sales tax, fringe benefits tax assessment and child support assessment, now runs to more than 6,700 pages administered by a Taxation Office staff of about 18,000.

(5) Because of its complexity, compliance with the Act involves very detailed and time consuming record keeping by all income earners and, even for modest income earners, increasing recourse to accountants and tax agents. Because the same kinds of records and associated calculations are required irrespective of corporate size, the costs of compliance relative to overall operations and staff numbers tend to be proportionately greater and more burdensome for smaller businesses (and particularly so in the case of fringe benefits tax).

(6) While all taxes tend to inhibit employment, payroll tax (introduced to divert non-essential civilian employment to defence-related employment during World War 2, but retained ever since as a revenue measure and subsequently transferred from the Commonwealth and administered at variable rates by the states) is a very direct tax on employment diametrically in conflict with employment policy objectives; and wholesale taxes are a cumulative impost on business inputs.

(7) State “land taxes” have long since ceased to represent a land value charge for the occupation and use of the community’s land resources and have become merely a discriminatory and arbitrarily assessed wealth tax levied on major landowners at varying rates and subject to varying exemptions and commencement thresholds.

(8) There are anomalies in the administration of property rates which are the main source of revenue raised by local governments. In the states where they are levied on improved capital values (ICV), rates operate as a disincentive to development and are conducive to urban blight. Under ICV rating, i.e. on the value of land plus improvements, landowners pay less while their land remains unimproved and speculative withholding of land from productive use exacerbates urban sprawl and increases the cost of providing urban works and services. (ICV rating is also regressive, since the land component of properties owned by the wealthy, e.g. in premium locations, is likely to be greater than the land component of middle and lower income housing. Relatively, therefore, middle and lower income earners pay higher rates in respect of their dwelling places.)

(9) When state or local governments grant permission, by rezoning or otherwise, to use land for more intensive development, the approval confers on landowners – literally overnight – a substantial increase in land value which is only partly offset by the development contributions required from land developers (or, in the ACT, by a betterment levy). Failure to capture the whole of such increases in land value represents a massive loss of public revenue. The extent of potential public revenue from this source being forgone in Australia was estimated by the National Capital Development Commission in 1992 to be in the order of $300-400 million annually.

(10) Windfall increases in land value attributable solely to the obtaining of planning permission are inflationary (since they do not represent any commensurate increase in actual goods or services) and the inflated value is passed on to all end consumers of the land. Whereas developers are entitled to profit from the competitive quality of their actual developments on land, windfall increases in land value are effectively an unquantified and totally unwarranted subsidisation of the development industry. Notwithstanding any limits or boundaries which planning schemes purport to impose, the prospect of land value profit contributes to urban sprawl, and renders all land vulnerable to development pressures, regardless of its environmental significance and regardless of genuine market demand, effectively making a mockery of the town planning system. The integrity of the system is undermined, and open public participation in land use decision-making is prevented because of the risk of land speculation prompted by inside knowledge of the proposed direction of future urban expansion.

(11) A further consequence of the failure of governments to recoup as revenue the betterment in private land values created by public planning decisions is the reluctance and/or alleged incapacity on the part of governments to compensate fairly property owners whose properties are devalued by public planning decisions (for example, by the proximity of freeways and airports).

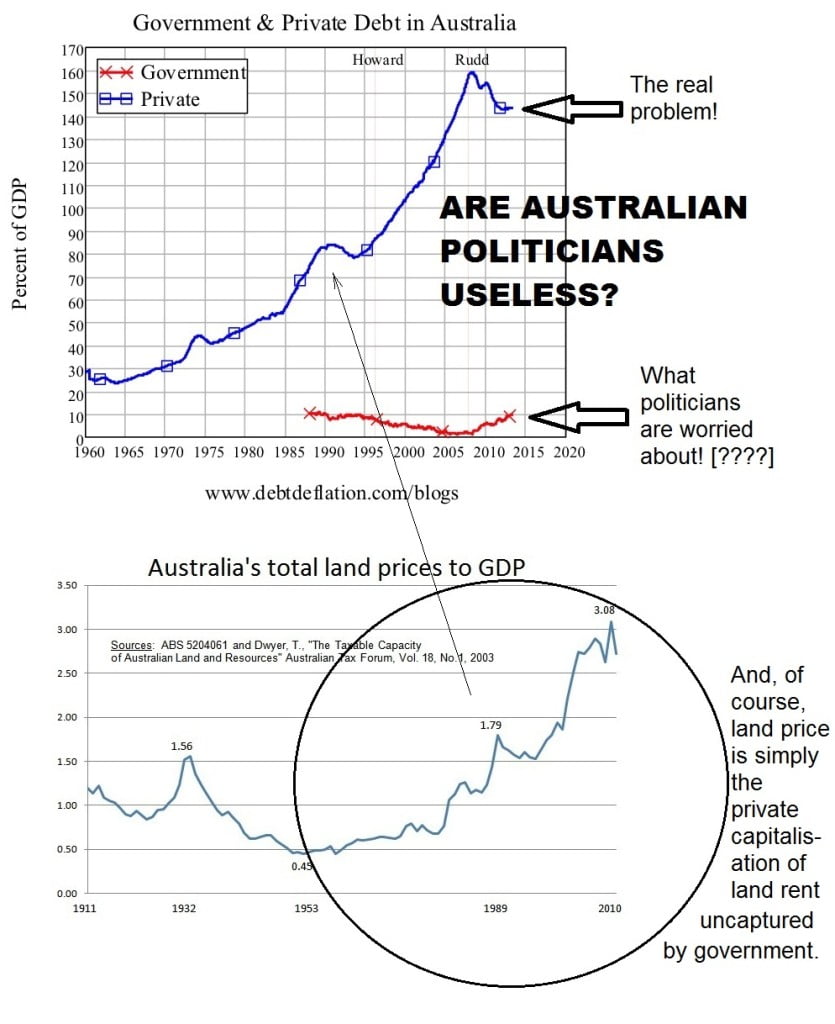

(12) Historically a consequence of the disproportionate reliance upon the taxation of personal exertion and productive capital and the low incidence of charges levied on the consumption of the community’s land resources has been an inordinate diversion of national savings into land and property at the expense of investment in the manufacture of productive goods and services and national development. As an EPAC paper reported in 1993, “income tax encourages individual Australians to direct their savings towards property rather than new business investment”. At the peak of the property boom in 1989 the total value of real estate sales in Australia had risen to $87.709 billion, of which the estimated land value component was some $61.4 billion (equivalent to about 22 percent of national income, and nearly equivalent to total share market sales of $68.2 billion at their peak in 1988).

(13) The low incidence of charges presently levied on land is a major cause of socio-economic inequality. Unearned wealth accruing from land ownership is cumulative. While the average homeowner may benefit when the value of the land component of his/her property increases incrementally with community development and population growth, the profits reaped by land speculators increase not only incrementally but exponentially when changes in permitted land use are approved by public planning agencies to meet the demand for land created, not by landowners, but be those needing land for housing and productive enterprises. [ One of the most concise enunciations of the fact that landowners do not create land values is that attributed to Winston Churchill in 1909 when he was President of the U.K. Board of Trade: “Every form of enterprise, every step in material progress, is only undertaken after the land monopolist has skimmed the cream (of increased land prices) off for himself … and is able to levy his toll upon all other forms of wealth and upon every form of industry.”]

•2. It is submitted that the multiple deficiencies and incongruities inherent in current revenue raising practice in Australia are demonstrable, substantial and indefensible.

•3. A value-added or goods and services consumption tax has been advocated in some quarters as a means of altering the balance of direct and indirect taxation by reducing the incidence of personal and corporate income tax and, by implication, some of the negative impacts of income tax on investment and production. However, while a GST would mitigate the disincentive impact of income tax on initial savings and productive investment (and could be substituted for the present wholesale taxes on business inputs), it would transfer the disincentive by penalising instead the consumption of goods and services which business produces. Moreover, while a GST on luxury goods purchased by the wealthy would compensate for some of the revenue lost through tax minimisation devices employed by high income earners, all indirect taxes tend to be a hidden regressive impost on lower income earners, and a GST would be both inflationary and unconscionably regressive unless basic foodstuffs and other necessaries of life were exempted (by way of inevitably complicated and arguably arbitrary exemptions). Any bargaining of a GST in exchange for other tax relief would seem a dubious basis for genuine taxation reform.

PHILOSOPHY AND RATIONALE

• 4. While present revenue raising practice in Australia is characterised by shortcomings and incongruities which ought to be remedied, reform should not proceed in isolation from some attempt to spell out and clarify an acceptable philosophy and rationale of public revenue raising.

• 5. That any civilised community needs some communal revenue to provide those goods and services considered necessary for communal wellbeing which cannot adequately be provided by individuals acting independently is a simple enough proposition.

• 6. Acceptance of this simple proposition will obviously be subject to legitimate debate about acceptable standards of communal wellbeing at any given time. However, it is also presently clouded, not only by the self-interest and cupidity which are ever present characteristics of the human species, but by a prevailing perception that revenue raising in practice is characterised by a continually changing grab-bag of politically manipulated measures the avoidance of which is a standing challenge to taxpayers’ ingenuity.

• 7. The situation is further compounded by contradictions in Australia which need to be honestly confronted.

• 8. There are, for example, divisive and patently irreconcilable factors which bear upon the amount of public revenue which needs to be raised. On the one hand there are pressures to improve the range and quality of public services and remedy perceived shortcomings in their provision, the evidence of which across the spectrum of national and community life is readily apparent and daily reported.

• 9. On the other hand there are pressures, popularised by the media and short-term political aspirations, operating to minimise revenue raising in accordance with an acculturated aversion in principle to “taxes” and an arbitrarily assumed upper limit to revenue raising (conducive to endless debate about budgetary deficits – like a family lamenting its incapacity to make ends meet, but whose members perversely refuse to put any more money in the kitty).

• 10. An acculturated aversion to revenue raising is reflected in fashionable pressures to privatise community works and services in the expectation of reducing the need for public revenue – notwithstanding that the privatisation of natural monopolies is difficult to reconcile with fostering cohesive communities and providing them with tangible physical symbols of community identity and shared ownership (and notwithstanding that there is no evidence that a well-managed public sector is necessarily less efficient than the private sector). While privatisation in the interests of competition is arguably desirable, in the case of natural monopolies privatisation tends to be an abdication of community responsibility, a contracting out, at odds with the interdependence upon which hopes of an environmentally sustainable global society must ultimately depend.

• 11. Equally fundamental are the public revenue implications of a style of living which is dependent upon capital-intensive technology and increasingly skilled labour: An economic system which measures efficiency by the labour it can displace is impossible to reconcile with continuing population growth and the maintenance of full employment. The expectation that more development of the same kind will somehow solve the problem is demonstrably a delusion, and its implications for the finite planetary environment need to be recognised. Short of a fundamental change in lifestyle, public revenue will be needed to forestall the emergence of a permanently unemployed or under-employed – and increasingly alienated – underclass [ a prospect with potentially apocalyptic consequences globally if inequality becomes intolerable in the third world “tiger economies”] by subsidising the sharing of skilled jobs and expanding labour-intensive community improvement works and services.

• 12. There are other contradictions. Popular advocacy of affordable access to land for low-income home-seekers, for example, sits strangely with property owners’ expectations of profiting from increasing land prices; and a variation of the same phenomenon is the approbation by property owners of increasing land values coupled with resentment of consequential increases in their local government rate bills.

• 13. Pursuing further these philosophical considerations is beyond the scope of this submission. Suffice it to submit that taxation reform ought to be predicated on a clearly enunciated concept of community responsibility and on revenue raising measures which are commonly perceived to be equitable, morally and logically sustainable, and conducive to compliance, and which in themselves reinforce and contribute to social cohesion.

A GRADUAL SHIFT OF EMPHASIS

A comprehensive remedy

• 14. A revenue source which would avoid all the previously listed deficiencies (and which technically does not warrant appellation as a “tax”) is a charge upon the occupation or use of the community’s finite natural resources, more particularly a charge upon the occupation or use of land, the basic resource upon which, or from which, all human activities are conducted.

• 15. Compared seriatim with the deficiencies listed in this submission, a shift of emphasis in favour of a charge upon land, that is to say on the value of raw unimproved land (as defined for the purposes of rating in Queensland, NSW and the ACT and in some of the local government areas in the other states) –

(1) would avoid penalising work, skill, enterprise, inventive genius, self- reliance and saving, and the contradictions presently inherent in welfare administration;

(2) would be impervious to individual manipulation or miscalculation, and be impossible to evade or avoid;

(3) would ensure the receipt of revenue from every individual or corporate entity occupying land in Australia whether as owner, lessee, tenant or licensee, irrespective of their external financial transactions (and irrespective of nationality or domicile):

(4) would utilise already existing land planning and valuation agencies and mechanisms and require relatively simple enabling legislation;

(5) would reduce payee compliance costs literally to zero (the benefit of which would be relatively greater for small businesses);

(6) would not penalise employment, unlike virtually all forms of taxation, particularly payroll tax; and would not impact upon business inputs like existing wholesale taxes, or upon business outputs like a goods and services tax;

(7) would not operate, like state land tax, as a discriminatory wealth tax levied arbitrarily on certain categories of property owners;

(8) would encourage the improvement of land and discourage the withholding of land from productive use and the consequent exacerbation of urban sprawl;

(9) would automatically reclaim as public revenue all increases in land value attributable to public planning decisions and eliminate the inflationary impact of such increases on the cost of land to end consumers;

(10) would safeguard the integrity of public land use planning systems, and protect the environment from development primarily motivated by the lure of windfall increases in land value;

(11) would automatically ensure the compensation of property owners whose properties are devalued by public decisions;

(12) would discourage the diversion of national savings into unproductive property speculation; and

(13) would prevent unearned wealth derived from land ownership accentuating socio-economic inequality.

•16. Compared with a conventional GST a charge on land value is deflationary, imposes no compliance costs, recoups revenue from the wealthy according to the value of the land they occupy, and does not penalise the production of socially desirable goods and services. Instead, it is effectively a consumption tax on land, arguably the most natural and intrinsically justifiable subject of a consumption charge.

• 17. If levied, as a major source of public revenue, in the form of an annual rental payment equivalent to the annually assessed market rental value of land, it would avoid completely the listed deficiencies. If in the first instance it were levied at a rate less than the assessed market rental value, it would mitigate them proportionately.

• 18. As an indication of the approximate order of magnitude of an annual rental charge as a revenue source, the total annual rental value of land in Australia in 1993 has been estimated at $48.35 billion (adopting a capitalisation rate of 8.5 percent and working back from the official Commonwealth Grants Commission figure of $568.837 billion for the total value of rateable Australian lands in that year). For comparison income tax receipts in 1993 were $63.404 billion.

• 19. It is not suggested that a charge on land should replace all other revenue sources. In principle it is submitted that public agencies should rely as far as possible on user (or beneficiary) charges for public works and services which are not equally used, wherever the users or beneficiaries can be identified (subject always to an acceptable minimum standard of basic works and services being available to all members of the community irrespective of ability to pay). Governments moreover should be entitled to levy sumptuary taxes in pursuance of social policy objectives (for example, on petrol, alcohol or tobacco); to impose sales taxes and tariffs in pursuance of economic policy objectives; and to impose penalties for pollution and environmental degradation (and other anti-social behaviour). Constitutional barriers to the exercise of such taxing powers (such as that which restricts the states’ powers to tax fuel consumption) should be removed.

• 20. In economic theory a land value charge accords with both the ability-to-pay and beneficiary-pays principles of taxation. It also accords with the principle of universal contribution (but, unlike a poll tax, is not regressive). Of all revenue measures it least distorts the free market allocation of resources. Of itself a land value charge is revenue-neutral, and neutral moreover within the spectrum of interventionist and deregulated free market economic ideologies. The annual rental value of a parcel of land as assessed by the valuation process at any given time is a fixed amount which is not amenable to political manipulation. This would be ensured if the valuing authority, like the Auditor-General, enjoyed statutorily guaranteed independence.

• 21. Whatever the sources of public revenue, it seems likely that protecting and enhancing the environment and ameliorating environmental degradation will continue to be major policy objectives for government in the foreseeable future and require to be funded. In relation to the environment a land value charge is not only a transparent revenue source but a source which in itself positively deters speculative encroachment upon the environment.

• 22. Eliminating the capricious windfall profit motivation for land development would have the added advantage of sharpening the focus more appropriately on the competitive quality of actual development, its market demand and its optimum location, as well as its environmental implications.

• 23. The potentiality and merits of a charge on assessed land value as a public revenue source were endorsed unequivocally by the 1989 report of an exhaustive two-year review of public revenue raising conducted on behalf of the Lord Mayor of Brisbane by the Committee of Inquiry into Valuation and Rating headed by former Queensland Deputy Premier and Treasurer, Sir Gordon Chalk. The Committee concluded that, to supplement user charges for public goods and services, a charge upon the unimproved value of land – preferably expressed in the form of a charge upon its annual rental value – was the most equitable and efficient form of public revenue raising irrespective of the level of government. In the course of a systematic evaluation of alternative revenue options the Committee noted that a land value charge was inherently transparent and simple to comprehend, cost effective to operate, and virtually impossible to avoid.

• 24. Given the deficiencies inherent in current Australian revenue raising practice (and in particular the increasing vulnerability to avoidance and evasion of the revenue raising sources hitherto relied upon by nation states), it is submitted that the alternative of raising a substantial proportion of public revenue by charging for the consumption of the nation’s land resources is, on social, economic and environmental grounds, logically and morally unassailable.

Aim of this submission

• 25. This submission therefore seeks to place the principle of resources rental firmly on the national agenda and to seek irreversible bi-partisan acknowledgement that, inevitably, Australia must sooner or later move further in a direction which has already been partially acknowledged, and in which some tentative but uncoordinated steps have already been taken.

• 26. The necessary land planning, titles registration and valuation and appeals mechanisms already exist. [Although an increase in the status and number of valuers may be warranted; and the Commonwealth Treasury would be better equipped to guide economic policy if it monitored land transaction statistics which, curiously. it does not do at present.] In de facto recognition of land as a community resource and the fact that increases in land value created by the community should be recouped by the community, local government rates (whose antecedents date back over the centuries) already capture a percentage of land value for the community. Increasing recourse to betterment levies and developer contributions (negotiated haphazardly and unevenly by councils as an expedient means of securing the provision of some community infrastructure) is implicit recognition of the same rationale. So, too, was Commonwealth land tax when it was first introduced in 1910. And royalties, for example on minerals and petroleum, currently recognise community ownership of resources under the land.

Implications

• 27. The essential administrative mechanisms exist. The only fundamental change required is a cultural one: an explicit recognition that land itself (like air and water) is a finite community resource provided by nature, a resource which is intrinsically different and distinguishable from commodities and services and improvements on or to land which are produced by human labour (and for which the individual or corporate labourer is properly entitled to be rewarded).

•28. The logic is irrefutable. But while recognition of the true status of land is the one vital condition precedent, the vital single peg upon which reform depends, it would be naïve to ignore the difficulty of changing a long-ingrained mindset which has become reflected in the institutions and practices of society.

• 29. Intuitively, the notion of the private appropriation of air or water is utterly repugnant to contemplate. Yet, while tribal societies have instinctively rejected the private appropriation- of natural resources, the private appropriation of land has prevailed in western societies for centuries. It has persisted without being seriously questioned even though, historically, the private appropriation of land derives from nothing more noble or pre-ordained than the greed and power of those who first claimed absolute ownership; the abolition of the feudal fees attaching to grants of land from the Crown; the subsequent enclosure of the “common” lands; and the fact that landowners have dominated governments until the extension of the franchise in relatively recent times.

• 30. Paradoxically recognition that land ultimately belongs to the community still persists. It is reflected in the fact that unalienated land is literally “Crown” land. In the early years of European settlement freehold grants were subject to the payment of a small “quit-rent” to the Crown. The Crown everywhere enjoys the undisputed right to exercise the power of eminent domain and resume private land for public purposes. And in modern times increasingly sophisticated town planning controls severely limit the right of landowners “to do what they like with their own land” (a right which in any case can never be absolute in any organised society). Indeed, it is important to recognise that the extension of land use planning controls during the latter part of the present century, coupled with the advent of annual valuations, now provides a much more specific basis for establishing and maintaining an authoritative and up-to-date assessment of land values than hitherto.

• 31. Nevertheless, while the social, economic and environmental consequences of not distinguishing between land and man-made commodities are demonstrably far reaching, they are not commonly recognised. Assumptions about land “ownership” are powerfully embedded in the national psyche. Thus it needs to be stated that recouping increases in land value for the community by way of an annually assessed rental – more appropriately described as a community charge – emphatically does not imply the nationalisation of land, or the institution of leasehold tenure. Or disturbing exclusive possession of land, in perpetuity if so desired, by existing land proprietors.

• 32. Nor, importantly, does it mean inhibiting the free market buying and selling for profit of buildings or other improvements erected on land, or in any may inhibiting the legitimate expectation of homeowners to profit from increases in the value of the dwellings which they have bought or built with their life savings.

• 33. Nor does it imply limiting the amount of land which anyone may desire to occupy. Value, not area, is the determinant of a community charge (and for farmers and pastoralists, for example, the assessed annual value would automatically reflect adverse seasonal fluctuations and fluctuations in international commodity prices – in which case a variable annual community charge would be significantly less burdensome than fixed lease rentals or mortgage repayments).

• 34. The social welfare implications of a shift towards land value charges deserve to be noted. Arguably it would help to clarify a presently confused situation and more clearly identify and focus on genuine need. That reliance upon income taxation conflicts with fostering self-reliance on the part of welfare recipients has already been adverted to. What needs to be added is that the welfare burden would be reduced to the extent that (a) the land cost component of housing would be reduced; and (b) more affordable access to land and the forcing of land speculatively held vacant into productive use would increase the scope for productive enterprises to expand and for small entrepreneurs to establish themselves.

• 35. Residual welfare claimants would of course still require to be supported, which in practice would mean assistance in meeting their community charge liability (whether as landowners, lessees or tenants). In the case of the “asset-rich but income-poor”, a charge on land can be wholly or partially deferred, as is common practice with local government rates, since the charge remains attached to the land and is not a charge upon persons.

• 36. In the first instance a gradual increase in land charges raised via local government rates could be accompanied by a commensurate reduction in the Commonwealth’s transfer payments to local government raised via income tax. The process would have to be gradual. Private appropriation of land value increases has been taken for granted and institutionalised. Recouping for the community the annual rental value would reduce the capitalised price of a parcel of land and thus its value to its owner as personal security. Recouping the whole of the annual rental value would reduce the price to zero. In the long term the benefits would be immeasurable; access to land and possession of it thereafter would require only the payment of the annually assessed rental or community charge. No one except would-be land speculators would be disadvantaged. In the short term, however, the impact would be unconscionable unless it were ameliorated by compensating recent purchasers and those property owners who would not benefit commensurately from a simultaneous elimination of income tax (the asset-rich but income-poor).

• 37. No substantial taxation reform of course will be painless. While it is argued that what has heen outlined in the preceding pages is the only way all the enumerated present deficiencies can be ameliorated, the need to identify and provide for the necessary transitional adjustments is acknowledged. In the first instance, therefore, this submission urges a commitment in principle to staged implementation.

• 38. While implementation in Australia and other western societies would need to be staged over time, commitment in principle would provide free market economics with a universally applicable moral base which is currently lacking. It would temper the widespread impression among the peoples of eastern Europe and the third world that self-interest and greed are the primary motivations of the western economic model they are being urged to embrace. Closer to home, recognition and reaffirmation of the fact that land is a finite natural resource, the ultimate ownership of which resides in the community, would clearly be an enormously significant contribution towards reconciliation with Aboriginal Australia.

• 39. An opportune time

The challenge of fundamentally changing a long-ingrained mindset is not under-rated. Yet the time, it is submitted, is peculiarly opportune. The approach of the new millennium is inspiring a reassessment of the symbols of Australian nationhood and the century-old constitutional arrangements forged by negotiation and compromise in a colonial past. Paradoxically it is an opportunity to abolish land speculation and achieve at last one of the more enduring ambitions of the architects of Australian federation.

Signatories:

Philip D Day, LL.B, Dip.TCP, LFRAPI,

town planning consultant;

former Director, NSW Department of Decentralisation & Development,

Director, Australian Institute of Urban Studies,

Head, Department of Regional & Town Planning, University of Queensland;

author of “Land”.

Hon. Rae Else-Mitchell LL.B, D.Litt, CMG, QC,

former Judge of the NSW Supreme Court and Land & Valuation Court,

Chairman, Commonwealth Grants Commission,

Chairman, Commission of Inquiry into Land Tenures and Local Government Rating Valuation & Finance

Bryan Kavanagh AVLE (Val),

senior real estate valuer, Commonwealth Bank of Australia,

Research Director, Land Values Research Group;

former senior valuer with Australian Taxation Office & Australian Valuation Office .

J. Douglas Tucker BA, MPub.Ad.,

Senior Lecturer in Public Administration, Department of Government, University of Queensland, and an adviser to the Local Government Association of Queensland;

former Deputy Regional Director (Qld) Australian Public Service Board

This submission [to The Australian Tax Reform Summit (3 – 5 October 1996), sponsored jointly by The Australian Chamber of Commerce & Industry and the Australian Council of Social Security] draws upon research undertaken by the Land Values Research Group, Melbourne, and upon the report of the Committee of Inquiry into Valuation and Rating (Volume 1, 1989, Brisbane City Council). Amplification of the material in this submission will be found in “LAND: the elusive quest for social justice, taxation reform and a sustainable planetary environment” (Day, P.D., Australian Academic Press, Brisbane, 1995).

P.D. Day, 3/24 Croydon Street, Toowong Q.4066

20 August, 1996

Few positives to be found in negative gearing

By ABC’s Michael Janda

Posted Mon 7 Jul 2014, 3:06pm AEST

Negative gearing and our pro-debt tax system may help the wealthier few but in the long run it could come back to bite us all. What’s worse, the Reserve Bank is handicapped when it comes to guarding against this, writes Michael Janda.

Last week I wrote about the Bank for International Settlements’ attack on its central bank members for their low rate policies.

In its annual report, the BIS warned that low interest rates were fuelling booms in financial markets and asset prices, even while lending to businesses and economic growth remained slow.

It called for central banks to stop printing money and start lifting rates back towards more normal levels now, rather than leaving it for later when a more severe and sudden adjustment may be needed.

But the BIS didn’t lay all the blame for surging asset prices at the foot of the world’s central banks.

“It also means designing a tax code that does not favour debt over equity,” the bank urged in its report.

And Australia offers one of the best examples of a country where the tax system favours debt.

The prime culprit is negative gearing.

Usually only featuring in public debate in its real estate context, the ability to write of interest payments against other income is not just available to property investors, but also to shareholders, businesses and other investors.

But it’s the real estate sector that probably generates the biggest threat to financial stability, and a drain on economic growth as investment is diverted away from businesses towards bidding up home prices.

The Grattan Institute estimates that real estate negative gearing costs the Federal Government coffers about $4 billion a year, which might fall to a saving of about $2 billion a year if it were abolished as people would change their behaviour.

But this figure grows strongly every year, as surging property prices mean ever more investors now make a loss on their investment property.

Property investment surge

The number of property investors has jumped from 1.3 million at the end of last century to nearly 1.9 million in the latest 2011-12 financial year tax statistics.

Landlords back in 1998-99 managed to turn a combined profit of $700 million. On face value, the new ones who have jumped in appear to lack the same financial nous, as their losses stand at just under $8 billion.

The vast bulk of those losses come from more than $24 billion in deductions for interest payments.

Let’s face it, if you’re paying more in bank interest than you’re earning from your asset year after year – whether it’s rent from property or dividends from shares – there’s only one reason you’re holding onto it, and that’s capital gain.

When an investor buys an asset mainly for capital gain with little regard to income flows that is speculation.

When lots of investors do it at the same time, that is a bubble.

Excluding refinancing, housing investors now make up roughly half the new home loans being issued by Australia’s banks.

That preponderance is also showing up in a shift towards investment loans as a proportion of outstanding home borrowing.

Starting at about 14 per cent in 1990, investors now make up more than a third of the balance of all outstanding home loans.

High income tax minimisation scheme

It’s probably no coincidence that the big surge in investment loans came in the late 1990s, around the time the Howard government changed Capital Gains Tax rules to institute a flat 50 per cent discount in place of the previous indexation.

That’s because it’s been the interaction between the new CGT system and negative gearing that has created the opening for tax minimisation.

By itself, negatively geared property is clearly a bad investment – even though other taxpayers are subsidising your losses, you are still losing money.

But add in the prospect of capital gains taxed at half your normal income tax rate and the whole system begins to make more financial sense – at least while property prices keep rising.

If the rise in value is big enough, investors can stand to make a lot more from the low-taxed capital gains that they lost from their taxpayer-subsidised interest payments to the bank.

From a social equity standpoint, RBA statistics show that while 23 per cent of households in the top-fifth of income earners have an investment property loan, only 11 per cent of households in the next highest income bracket do.

For those on middle incomes, only 9 per cent have an investment property loan, and the proportion of investment loans for low-income earners is unsurprisingly negligible.

That shows negative gearing is overwhelmingly skewed towards lowering the tax bills of the relatively well-off, not benefiting the average mum and dad battler.

That is unsurprising, as it takes a pretty high income to be able to sustain all the interest-related losses on your investment property while you wait for its value to go up enough that you can flog it for a worthwhile tax-discounted capital gain.

In the long run everyone will lose

But back to the BIS and its financial stability focus.

From that point of view, the big problem with this tax system is that it encourages excessive household borrowing, subsidised by the public purse, and going into an asset class that does nothing to add to the country’s productivity or economic outlook.

Much of this money in Australia is actually imported from overseas via our major banks raising so-called wholesale funding offshore – Australia’s big foreign debt problem is not government-related, it’s our mortgages being underwritten by overseas investors.

Australia’s tax system, almost uniquely favourable to those borrowing money, means the Reserve Bank is handicapped in setting monetary policy.

In weak economic conditions, it cannot lower rates as much as it might want to encourage business borrowing and economic growth because it knows that housing investors will instead be the dominant borrowers to bid up home prices.

In stronger times, it cannot raise rates as much as it might if tax policies were different because Australian households are so indebted that even a small lift in mortgage costs might tip many thousands into default.

It also means that millions of Australians – both the negatively geared investors and the owner-occupiers that had to pay too much for their home because of competition from them – are vulnerable to the slightest economic shock because so much of their income goes towards repayments to the banks.

The winners?

In the short term, the banks that profit off the rising debt and the real estate sector that takes bigger commissions and bigger development profits out of the surging property prices.

That’s why these two sectors squawk loudest when any changes to these pro-debt tax concessions are proposed, such as Paul Keating’s attempt to wind back negative gearing in the mid-1980s.

But, in the long term, these sectors stand to join Australian property investors and homeowners as losers when the capital gains stop and the losses begin to bite.

Michael Janda is an online business reporter with the ABC. View his full profile here.

_________________________________________

A related topic: “Property spruikers warned by mail”

So there they were with Tony Jones on the ABC’s “Questions and Answers” last night: Christine Wong, Joseph Stiglitz and Ross Garnaut, representing the voice of reason,

and Judith Sloan standing in for the rent-seekers (and probably most Australians).

Anthony’s story deserves to go viral.

I don’t know you, Anthony, but good luck. Australia needs people who can think for themselves, so you’ll be sorely missed as part of our “brain drain”.

Yes, many of Australia’s young people are nothing less than wage slaves: enslaved to ludicrously excessive mortgages. Either that, or locked out of access by extraordinary land prices.

Bon voyage!