‘PRIVATE PROPERTY’

~~~~~

Although there are many reasons given for the cause of wars, at bottom, they’re all about the rights and wrong of land grabbing, the more recent of these being Ukraine and Palestine.

You may listen, as I did last night, to philosophers solicitously (and lengthily) excusing themselves on radio for getting into particular areas which may appear to be a little prejudicial to one side or the other but, incredibly, without at all commenting on the initial land grab. Fortunately, they appeared to see the war in Gaza as involving the deaths of (we) humans, rather than in terms of ‘collateral damage’ (as seemingly preferred by warmongers).

I’d earlier seen a little girl on the TV news say: “Palestine will be free because that’s their right to land.” OK, she may have been influenced by her parents, but one way or another she has come to see that the common right of people to land is paramount in understanding the Gazan war.

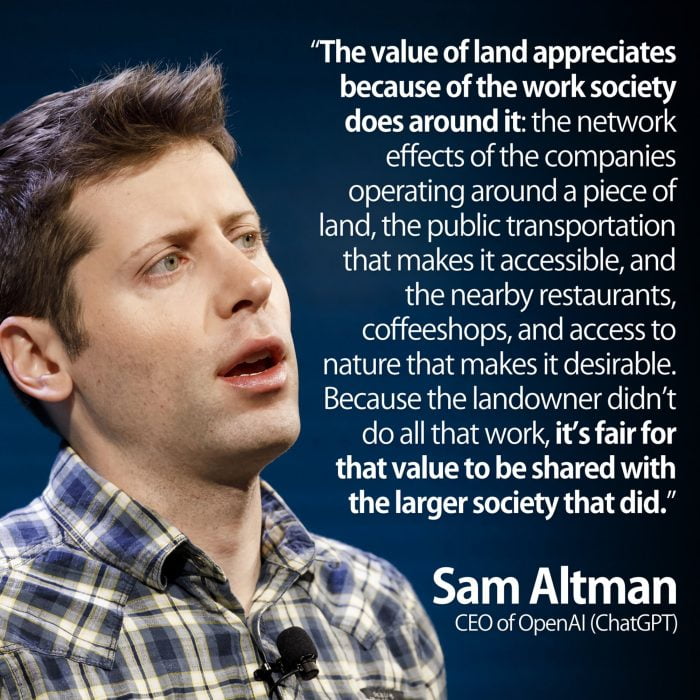

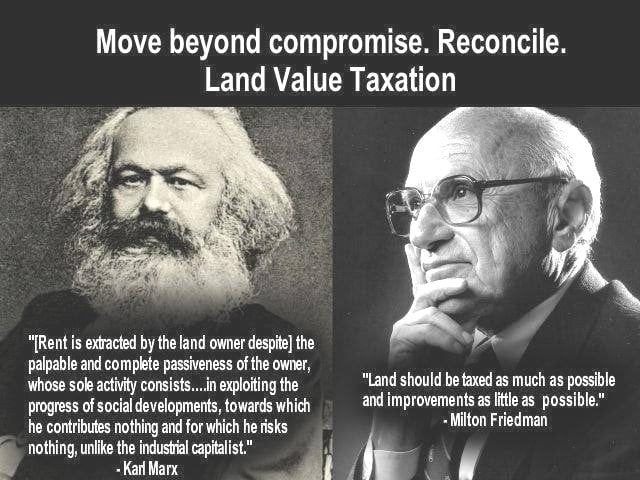

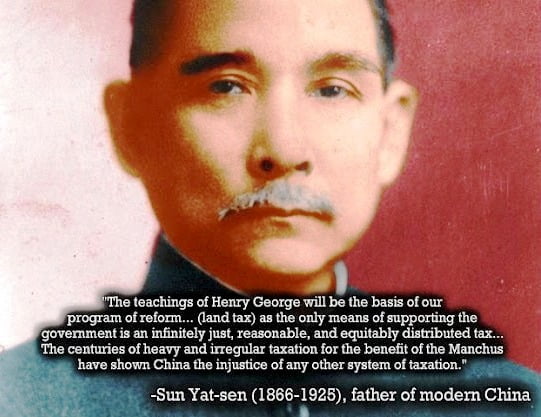

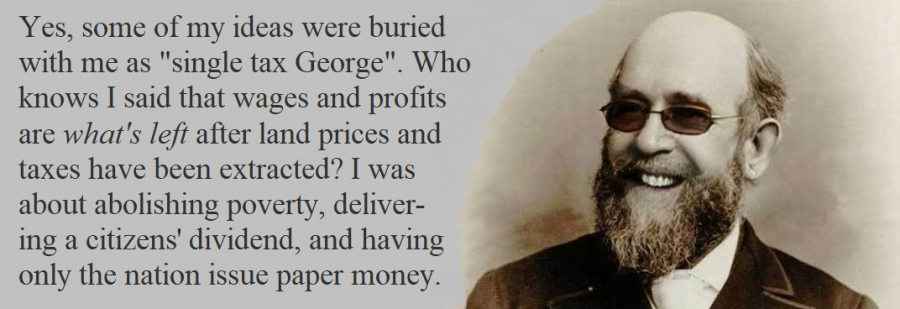

There are things that blind us to this understanding. The most important of these is that land is indeed the common inheritance of all humanity. Many of us have come to believe otherwise. Although we may have a title to the exclusive possession of a piece of land, that does not magically make land our ‘private property’. Our private property is all other things of ours other than the land to which we’ve been granted exclusive occupancy.

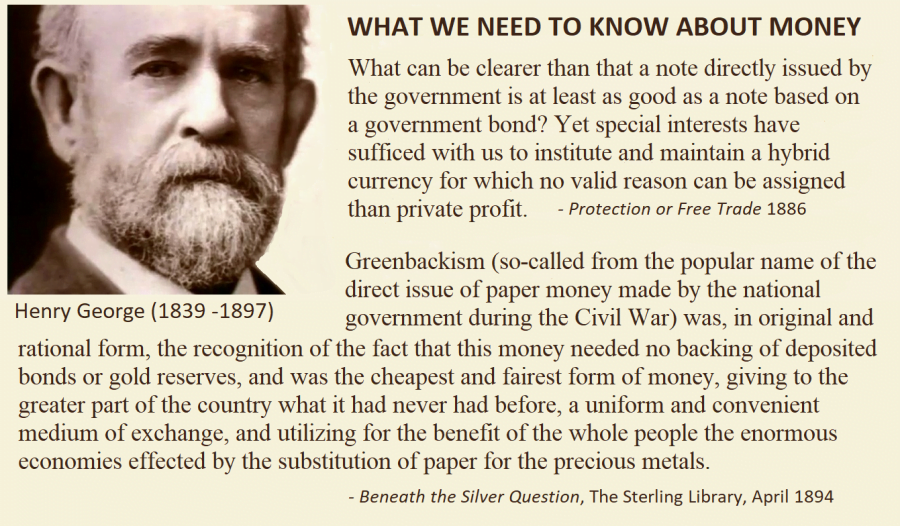

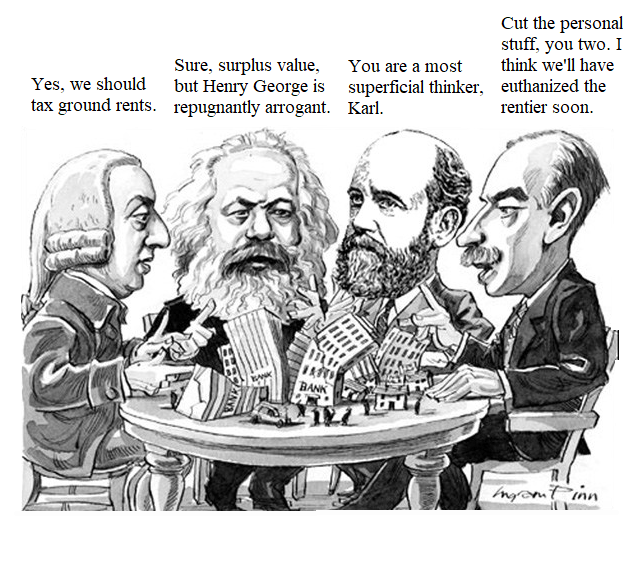

There was a bloke by the name of Jesus Christ who tried to make this point in terms of the Mosaic Law: that land is common to humanity and must be rented, not sold into perpetuity. He said he didn’t come to establish a new religion and got pretty upset with mortgage brokers in the temple. They certainly got him back, and Christians like to believe that ‘he died for our sins’ rather than having terminally pissed off the money lenders by physically confronting them. Apparently, he was wrong about the Mosaic Law though, because both Jews and Christians now believe that the more subtle form of chattel slavery–private ‘ownership’ of land–is OK. One bloke, the current Pope, still doesn’t believe this, and many Catholics want him removed for his ‘communist’ [read Henry Georgist’] views.

Land has become the ‘private property’ of those who accumulate it and go to wars to make further private property of it. Many of us have come to believe the commodification of land and all the socio-economic problems stemming from it are quite OK. They aren’t.

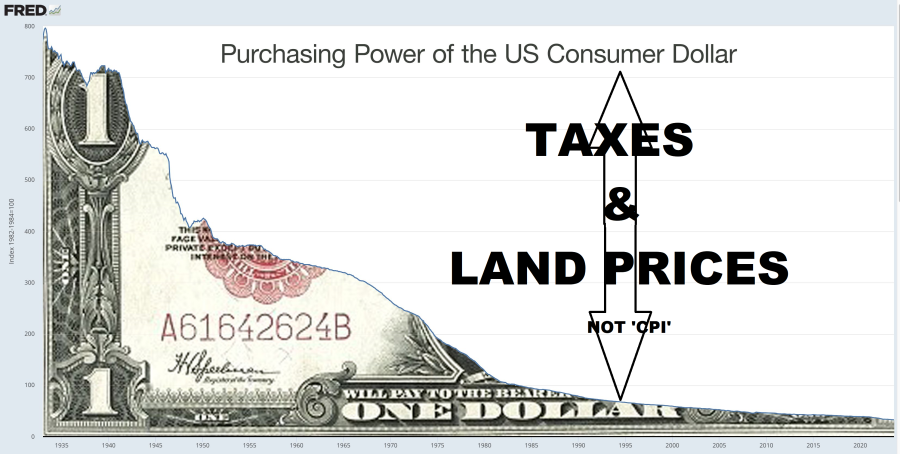

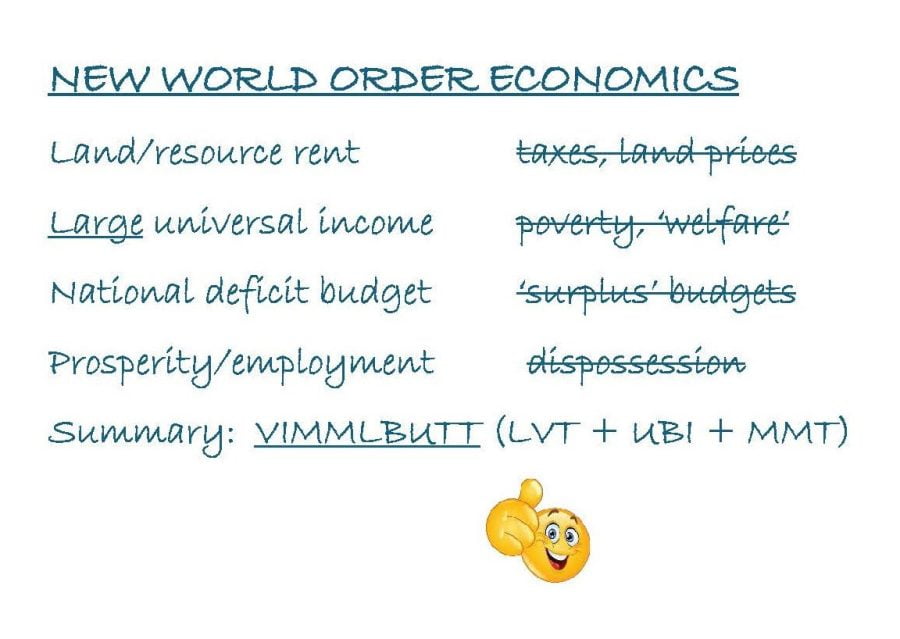

Maybe if we understood that inflation has very little to do with ‘consumer price inflation’ but rather the other ‘CPI’: cost-push inflation?